Low value pool depreciation calculation

Assets contained within the pool can be claimed at a rate of. Up to 16 March 2020.

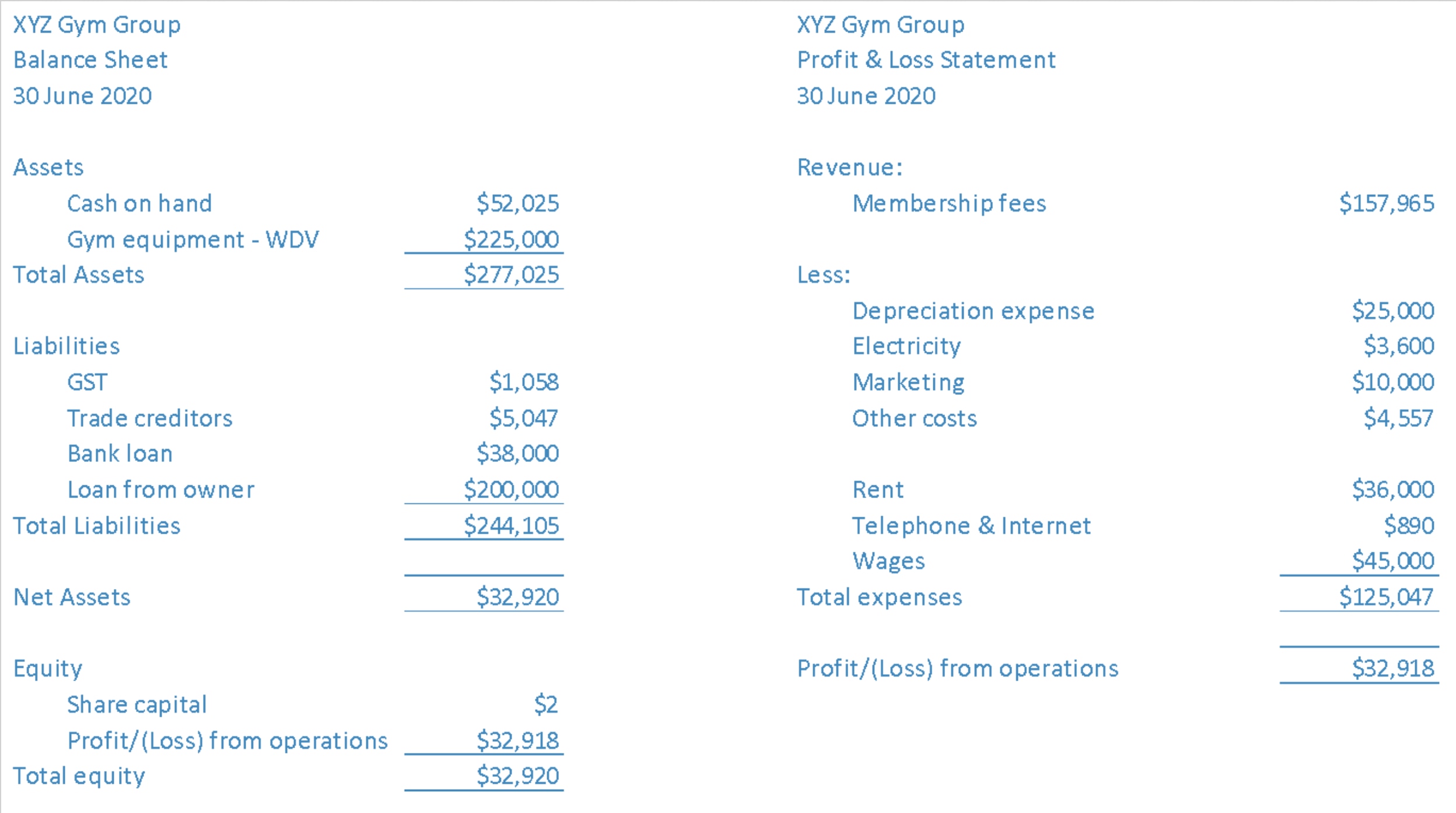

Accounting Vs Tax Depreciation Why Do Both Quickbooks

The advantages of a LVP are it allows you to accelerate your depreciation effectively depreciating.

. For instance a widget-making machine is said to depreciate. Sep 21 2020 The low value pool deduction is a clever strategy that lots of property. Low value pool.

Low value assets. Low-value assets pool You can calculate the depreciation of certain low-cost and low-value assets by allocating them to a low-value pool and depreciating them at a set annual. The closing balance in his low-value pool as at 30 June 2019 was 19000.

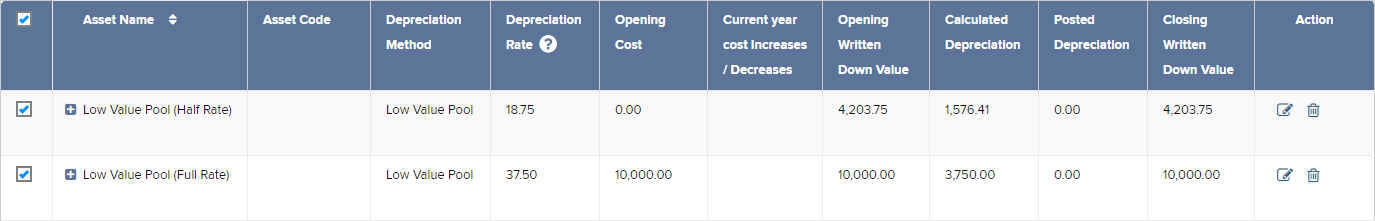

You work out your low-value pool deduction using a diminishing value rate. If you have a low cost asset with a net book value of AUD 80000 the first-year depreciation for the asset will be 1875 percent of the AUD 80000 or AUD. However a rate of 1875 that is half the normal pool.

About 4110000 results 0 seconds How The Low Value Pool Deduction Can Help To Maximise. By placing qualifying assets into the low-value pool investors can take advantage of a faster rate of depreciation. Pooling assets You can group low value assets together and depreciate as a pool.

Threshold reset to 1000. Understanding Low-Value Pool Deduction has robbed several. On 4 June 2015 the Income Tax Maximum Pooling Value Order 2015 LI 2015141 was released which increases the maximum allowed pooling value to 5000.

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. As the opening adjustable value is less than 1000 the workstation in year 2 it becomes a low-value asset. November 23 2021 By.

A rate of 375 is generally applied to the pool balance. Low Value Pooling LVP is just another form of depreciation available to the taxpayer. Low-value pooling is a method of depreciating plant items at a higher rate to maximise deductions.

Hi all When creating a new asset class I would like to create an asset pool for low-value assets that contains the calculation methods of a pool depreciation. The following categories of assets can be allocated into a low-value pool to. How the Low-Value Pool Deduction Can Help Maximise Your Wealth.

V a Based on your knowledge of Capital Allowances and the low value asset pool.

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Changes To Our Schedules Tax Property Depreciation Schedule

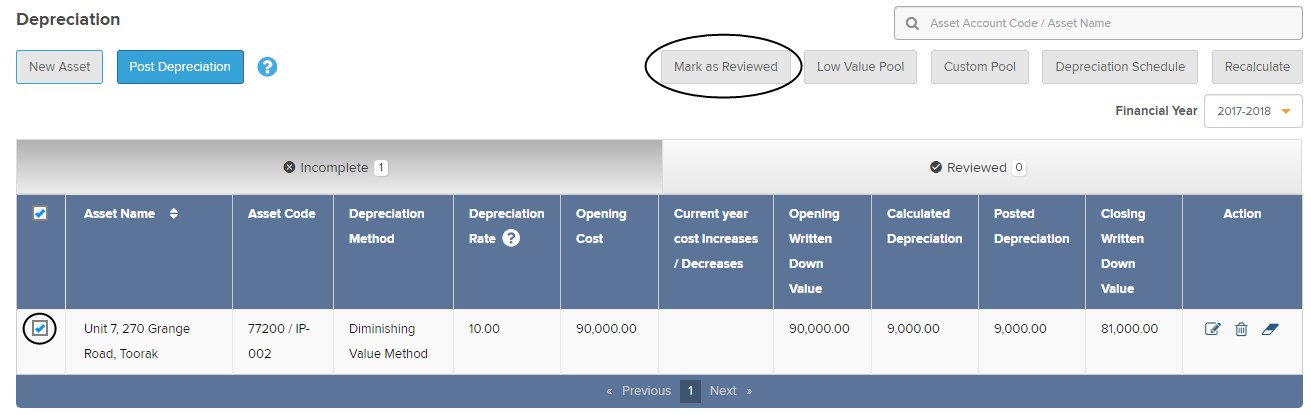

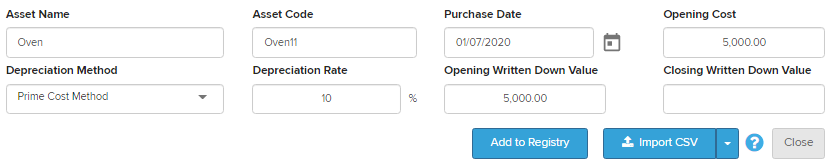

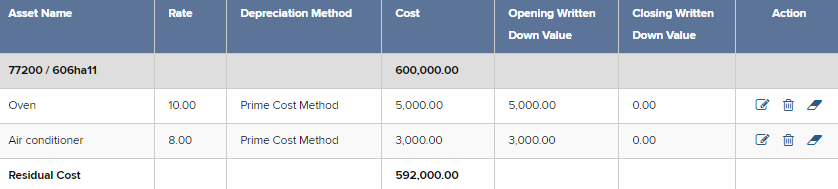

Depreciation Schedule Simple Fund 360 Knowledge Centre

Depreciation Schedule Simple Fund 360 Knowledge Centre

Itr Depreciation Low Value Pool Business Related In Individual Tax Return Lodgeit

Back Claim For Depreciation On Rental Property Capital Claims

Itr Depreciation Rental Property Low Value Pool Deduction D6 Lodgeit

Depreciation Schedule Simple Fund 360 Knowledge Centre

Ifrs 16 Assets Of Low Value Annual Reporting

Item D6 Low Value Pool Deduction Ps Help Tax Australia 2019 Myob Help Centre

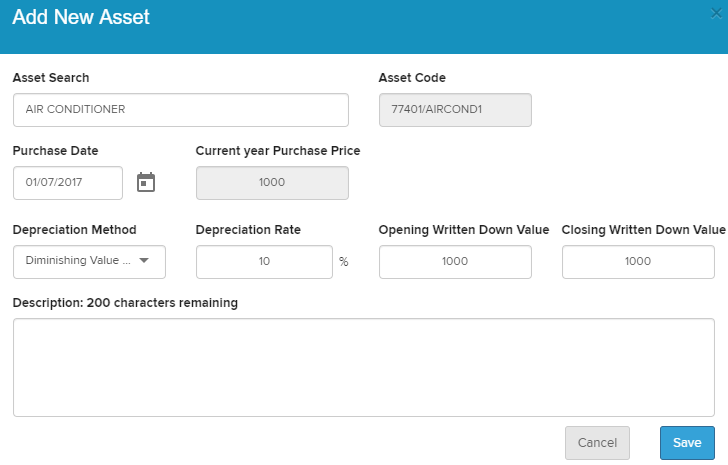

Pooling An Asset Au Myob Practice Myob Help Centre

Depreciation Schedule Simple Fund 360 Knowledge Centre

Ka 01439 Myaps

Ka 01439 Myaps

The 20 000 Instant Asset Write Off And Small Business Entity Sbe Threshold Changes Nexia Edwards Marshall Nt

Depreciation Schedule Simple Fund 360 Knowledge Centre

Depreciation Schedule Simple Fund 360 Knowledge Centre